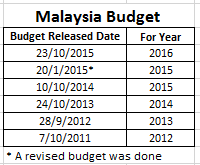

Malaysia Budget 2016 is coming soon on 23 October 2015. When the budget is released, normally the construction counters will be impacted and most construction counters tend to go up. So, i had done some studies on the effect of Budget towards the FBMKLCI and also the construction index (closing price on the announcement date, 1 week before/after, 2 weeks before/after, 4 weeks before/after and 8 weeks before/after). First let's look at the announcement dates. For 2015 budget, our PM had revised Malaysia budget because of the slump of oil price. All the data provided and forecast are based on previous year data, it might be incorrect. So, please have your own judgement and take these data as a reference.

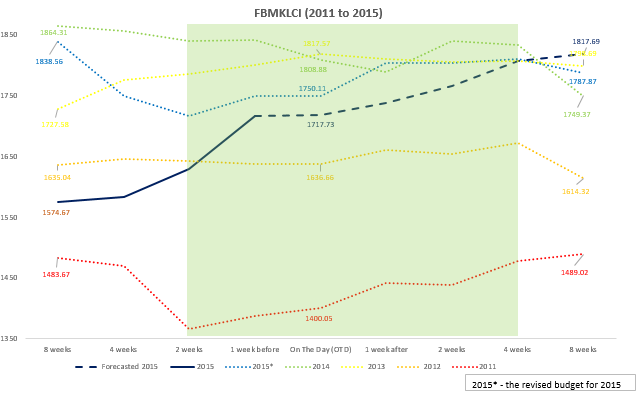

Now, lets look at our FBMKLCI. The sequence of the year is based on the colour of rainbow (red, orange, yellow, green etc etc)

First, to clarify, the grey readings in the 1st table is forecasted based on the average percentage (2011 to 2015*). From my analysis, the most prosperous time to invest during the Budget time is 2 weeks before to after 4 weeks (the highlighted area in the graph). Based on the increment percentage, the 2 weeks before the Budget day and 4 weeks after the Budget day is 0.81% and 2.38% respectively. Even 1 week before the Budget time to 1 week after the Budget time is also a good time, in which we see the increment of 1.26%.

Next, for the construction index.

From the table, the most prosperous time for construction index is closely correlated with our FBMKLCI, which is 2 weeks prior to the announcement date to 4 weeks after Budget announcement date, 0.98% and 4.77% respectively. So during these few weeks, i will invest in fundamentally good construction counters which the future prospects of those counters are very closely related to the Budget and also government projects/policies (11MP). Another sector that i personally think will benefit from the Budget announcement will be the telecommunication sectors. It had appeared in last 2 years of our Budget but seems like the action was not implemented. Maybe this year, they will walk the talk on the telecommunication sectors? But i feel it is worth to monitor the telco sectors also.

Again, i would like to reiterate that the data might be wrong, please perform your own study. The forecast is based on past year data's average and without considering the global market outlook and politics stability. Please have your own judgement.

Let's Ride the Wind and Gainvest

Gainvestor 10sai

18 October 2015

3.33pm

No comments:

Post a Comment