It is the last day of November and all the companies had released the Quarter Result. This is the last one that i had been waiting for... And in this post, i will include some of the findings that i find in the Annual Report 2015. You can refer to my first post on MIKROMB posted on 26 October 2015, by clicking this link, http://gainvestor10sai.blogspot.my/2015/10/mikromb-bomb-kaboom.html

1. Fundamental Analysis:

|

| MIKROMB Q1 2016 Result |

MIKROMB announces their First Quarter Result today, in the last day of November and also their Annual Report 2 weeks ago in November.

|

| Revenue and Net Profit |

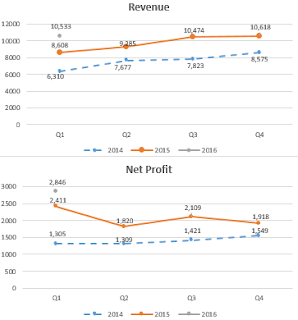

Let's talk about quarterly result first. By comparing with the same quarter, the revenue increased 22.36% due to the increase in sales. Not much surprise in net profit as it increased 18.04%[2]. So, for me, as long as the revenue and net profit is improving, then i think the business model is excellent. One thing to note here in the commentary on prospects, the current weakening of RM against USD is beneficial to MIKROMB in near term as the receivables in USD from oversea sales is higher than the payable in USD.

However, if the condition continues for a long run, MIKROMB will suffer because 63% of the revenue is derived from local sales. Mostly projects had been delayed to one or two years due to the slow economy. The management will intensify the efforts to improve oversea sales. As we can see from the charts on the left, the revenue and net profit are leading and growing every year. MIKROMB is a net cash company with 0.03 net cash per share. The average net profit margin from 2011 to 2015 is 17.82% while every year, the net profit margin exceeds 13%, which is a magnificent for a company like this.

Now let's take a look at the chairman statement in the Annual Report 2015. Export sales improved 67% to overseas market (Vietnam, India, Indonesia and Australia). MIKROMB is beginning to benefit from the brand equity and reputation. Their products are receiving the recognition from the global market. Latest landmark projects, such as KLIA 2, SP Setia HQ, Sunway Pyramid 3 and IOI Shopping Mall 2 at Putrajaya[3]. All of these projects are quite new, established in this year. As the business gathers momentum, MIKROMB need to expand capacity in order to fulfill anticipated sales demands and prevent stunting revenue growth due to capacity constraints[1]. They had acquired a vacant production factory which was approved on 6 November. While focusing at the domestic market, they will make more even inroads into oversea markets.

Now this is the main point, which really catches my eyes for possible long term investment. The adoption of M2M (Machine 2 Machine) connectivity and IoT (Internet of Things) is growing. MIKROMB is embracing this technological change, not only because it is inevitable but also because it promises new frontiers and rewards. So far i had not seen a company focusing in M2M and IoT. These technologies will play an important role in the future and as far as i am concerned, in Annual Report, MIKROMB had already conducted Research and Development (R&D) on M2M and IoT. In fact, they are the fastest company to engage on these technologies. For me personally, these technologies will one day conquer the world as all the big companies will be using them. I am not going to talk more on M2M and IoT, you can watch the link below in YouTube, https://www.youtube.com/watch?v=UTTv9wesbao. Well i believe in these new technology, and MIKROMB had already on the road to have these technology.

|

| Trade Receivables |

The trade receivables is basically the amounts billed by a business to its customers when it delivers goods or services to them. In this case, MIKROMB delivers the electrical equipments the customers. The trade receivables for Malaysia and Vietname had reduced 4% respectively, while India, Singapore, Indonesia and others had increased tremendously to 63%, 57%, 289% and 2329% respectively. The one i highlighted in yellow is basically that will benefit the company to have foreign exchange gain. The foreign trade receivables had increased from 15% in 2014 to 20% in 2015, which might increase the foreign exchange gain by 5% compared to 2014.

2. Technical Analysis:

|

| MIKROMB Weekly Chart |

For MIKROMB, i use the weekly chart to observe. As of today (30 November 2015), MIKROMB was having panic selling but then the price picked up before the end of the day. The advance movement prior to the announcement of Quarter Result is strong in the beginning of November but the energy is growing weaker and weaker until last week whereby a lot of profit taking activities happened. As of the weekly chart, the MACD still looks bullish, even though the price had retraced to the middle band. I had drawn the first support at 0.39 which is near to the middle band, and another second support at 0.36, closer to the lower band and also the MA50 of the weekly chart. In the mid term, MIKROMB is still bullish but remember to respect the 3-in-1 support line of 0.36. If violated, please cut loss immediately. The next immediate resistances are 0.415 and 0.435. The chart needs to break 0.415 before challenging the 0.435.

Summary:

MIKROMB currently is lacking some catalyst in the short term, but its business model is still steady and ready to overtake its own record every year. I personally like the technology of M2M and IoT, and i hope they will be the first company in Malaysia to roll out these technology in Malaysia.

- Net cash per share of 0.03

- Excellent and unique business model with few competitors in Malaysia whereby they manufacture the electrical equipments themselves.

- This year, the mega projects they had involved are Sunway Pyramid 3, KLIA 2, IOI Shoppin Mall Puchong etc.

- Ventured into R&D of M2M (Machine to Machine) and IoT (Internet of Things) which is getting the attention in heavy industries around the world. If MIKROMB had successfully integrated these technologies in their electrical products, they will be the first company in Malaysia to do that. (Try to google or youtube the definition and the impact of M2M and IoT)

- I believe M2M and IoT will be another long term theme play for equity markets.

- Based on the Quarter Result, 63% revenue is generated in Malaysia. In short term, MIKROMB will benefit from RM weakening, in long term, it will affect their business.

- The foreign trade receivables had increased from 15% in 2014 to 20% in 2015, meaning to say the business is expanding to international countries (Vietnam, Iran, India and Others)

- The proposal of acquiring property for long term investment to increase production capacity and storage purposes for RM11.75 million had been approved and expected to move in the new location in Q2 of 2017.

- Having uptrend channel but recently broken due to profit taking activities and volatility in market.

- Supports at 0.39 (supported by weekly chart's Bollinger Band middle band) and 0.36 (weekly chart's Bollinger Band lower band and MA50). meanwhile resistance at 0.435.

- Respect cut loss point at this moment.

- Beware of window dressing activities also.

- Excellent and unique business model with few competitors in Malaysia whereby they manufacture the electrical equipments themselves.

- This year, the mega projects they had involved are Sunway Pyramid 3, KLIA 2, IOI Shoppin Mall Puchong etc.

- Ventured into R&D of M2M (Machine to Machine) and IoT (Internet of Things) which is getting the attention in heavy industries around the world. If MIKROMB had successfully integrated these technologies in their electrical products, they will be the first company in Malaysia to do that. (Try to google or youtube the definition and the impact of M2M and IoT)

- I believe M2M and IoT will be another long term theme play for equity markets.

- Based on the Quarter Result, 63% revenue is generated in Malaysia. In short term, MIKROMB will benefit from RM weakening, in long term, it will affect their business.

- The foreign trade receivables had increased from 15% in 2014 to 20% in 2015, meaning to say the business is expanding to international countries (Vietnam, Iran, India and Others)

- The proposal of acquiring property for long term investment to increase production capacity and storage purposes for RM11.75 million had been approved and expected to move in the new location in Q2 of 2017.

- Having uptrend channel but recently broken due to profit taking activities and volatility in market.

- Supports at 0.39 (supported by weekly chart's Bollinger Band middle band) and 0.36 (weekly chart's Bollinger Band lower band and MA50). meanwhile resistance at 0.435.

- Respect cut loss point at this moment.

- Beware of window dressing activities also.

Let's Ride the Wind and Gainvest

Gainvestor 10sai

1 December 2015

12.45am

Sources:

[1]: http://gainvestor10sai.blogspot.my/2015/10/mikromb-bomb-kaboom.html

[2]: Q1 2016 Report

[3]: Annual Report 2015

[4]: M2M and IoT: https://www.youtube.com/watch?v=UTTv9wesbao

[2]: Q1 2016 Report

[3]: Annual Report 2015

[4]: M2M and IoT: https://www.youtube.com/watch?v=UTTv9wesbao

No comments:

Post a Comment